North Korea Increases Aid to Russia, Mos... Tue Nov 19, 2024 12:29 | Marko Marjanovi? North Korea Increases Aid to Russia, Mos... Tue Nov 19, 2024 12:29 | Marko Marjanovi?

Trump Assembles a War Cabinet Sat Nov 16, 2024 10:29 | Marko Marjanovi? Trump Assembles a War Cabinet Sat Nov 16, 2024 10:29 | Marko Marjanovi?

Slavgrinder Ramps Up Into Overdrive Tue Nov 12, 2024 10:29 | Marko Marjanovi? Slavgrinder Ramps Up Into Overdrive Tue Nov 12, 2024 10:29 | Marko Marjanovi?

?Existential? Culling to Continue on Com... Mon Nov 11, 2024 10:28 | Marko Marjanovi? ?Existential? Culling to Continue on Com... Mon Nov 11, 2024 10:28 | Marko Marjanovi?

US to Deploy Military Contractors to Ukr... Sun Nov 10, 2024 02:37 | Field Empty US to Deploy Military Contractors to Ukr... Sun Nov 10, 2024 02:37 | Field Empty Anti-Empire >>

Promoting Human Rights in IrelandHuman Rights in Ireland >>

Trump the Philosopher Sun Jun 29, 2025 07:00 | James Alexander Trump the Philosopher Sun Jun 29, 2025 07:00 | James Alexander

Trump is great because he calls a spade a spade, which is unheard of in Western politics, says Prof James Alexander. What's more, sometimes, as we saw with Iran, he refuses, like the philosopher, to take sides.

The post Trump the Philosopher appeared first on The Daily Sceptic.

News Round-Up Sun Jun 29, 2025 00:09 | Will Jones News Round-Up Sun Jun 29, 2025 00:09 | Will Jones

A summary of the most interesting stories in the past 24 hours that challenge the prevailing orthodoxy about the ?climate emergency?, public health ?crises? and the supposed moral defects of Western civilisation.

The post News Round-Up appeared first on The Daily Sceptic.

Does Reform UK Need to Move to the Centre to Win in 29? Sat Jun 28, 2025 17:00 | Joe Baron Does Reform UK Need to Move to the Centre to Win in 29? Sat Jun 28, 2025 17:00 | Joe Baron

The conventional wisdom inside the Westminster bubble is that elections are won on the centre ground. Ignore this PPE bromide, Joe Barron tells Nigel Farage. Stick to your Right-wing agenda.

The post Does Reform UK Need to Move to the Centre to Win in 29? appeared first on The Daily Sceptic.

Parents Can Remove Children From Classes With LGBT Books, US Supreme Court Rules Sat Jun 28, 2025 15:00 | Will Jones Parents Can Remove Children From Classes With LGBT Books, US Supreme Court Rules Sat Jun 28, 2025 15:00 | Will Jones

Parents can take their children out of classes if they are reading books with LGBT characters and storylines in them, the US Supreme Court has ruled, as the US upholds a parental right denied in the UK.

The post Parents Can Remove Children From Classes With LGBT Books, US Supreme Court Rules appeared first on The Daily Sceptic.

The Lab-Engineered Pandemic Sat Jun 28, 2025 13:00 | Dr Roger Watson The Lab-Engineered Pandemic Sat Jun 28, 2025 13:00 | Dr Roger Watson

Has the mystery of Covid's origins been solved? Jim Haslam thinks so and has written a book detailing his research. Professor Roger Watson reviews it for the Daily Sceptic.

The post The Lab-Engineered Pandemic appeared first on The Daily Sceptic. Lockdown Skeptics >>

Voltaire, international edition

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en Voltaire Network >>

|

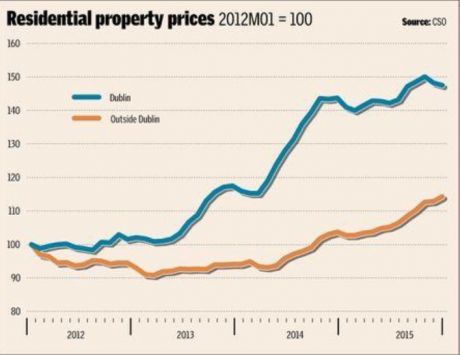

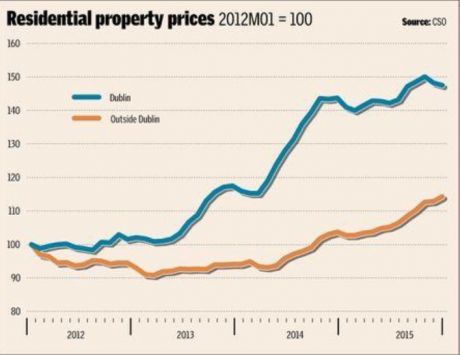

People's News: Another housing bubble building!

national |

housing |

press release national |

housing |

press release

Monday February 27, 2017 22:18 Monday February 27, 2017 22:18 by 1 of Indyy by 1 of Indyy

News Digest of the People’s Movement - No. 162 15 February 2017

The latest issue of People's News -for 15th Feb carries a lead article on the current housing bubble.

The free movement of capital has become one of the maxims of global capitalism. Along with the free movement of people, goods and services it is also one of the “four freedoms” of the EU’s single market.

But the removal of the policy instrument of capital controls has probably contributed to a succession of financial crises. Three decades ago, many people in the EU invested their hopes in a combination of free trade, free mobility of capital, a fixed exchange rate, and an independent monetary policy — dubbed an “inconsistent quartet.”

The combination is logically impossible. If Ireland, say, fixed its exchange rate to the German mark — which in effect it has done by adopting the euro — and if capital and goods move freely across borders, the Central Bank would have to follow the policies of the German central bank, the Bundesbank — or, in effect, the EU Central Bank in Frankfurt.

So we sacrificed monetary independence when we adopted the common currency. What has changed since then is the increasing importance of cross-border finance. Many emerging markets do not have a sufficiently strong financial infrastructure of their own. Companies and individuals therefore take out loans from foreign institutions denominated in euros; and that’s what the Irish banks were doing a decade ago.

Theoretically, it is the job of the Central Bank to bring the ensuing havoc to an end, which standard economic theory suggests it should be able to do so long as it follows a domestic inflation target. But if large parts of the economy are funded by foreign money, its room for manoeuvre is limited.

In the good times, credit flows into peripheral markets, fuelled by the massive German surplus, where it fuels local asset price bubbles, as we have experienced to our detriment. When, years later, liquidity dries up and the hot money returns to safe havens in Europe, the country is left in a mess.

Unless you accept financial instability as inevitable — and it increasingly seems an intrinsic part of the system as the time between crises grows shorter — you may soon be thinking about imposing capital controls that involve telling foreign investors that you don’t want their cash. The point is to prevent hot money flowing in during the good times and to stop it from draining out in the bad times.

This is not yet a subject of polite conversation among policy-makers. Central bankers have instead been peddling a concept known as macro-prudential regulation, a version of capital controls. The idea is to tweak incentives: when a housing bubble seems to be building up, the Central Bank imposes some ceiling on lending, for example by capping loan- to-value ratios. It might also ask its government to raise stamp duties or other transaction taxes.

Spain tried such measures during the precrisis years, and Ireland is trying it now. But it did not stop the buildup of one of the biggest housing bubbles in history.

More drastic action, such as leaving the euro or imposing controls on capital, might prevent the next calamity as rents and house prices soar. Spain did neither, but before long someone will — and it looks increasingly like it should be Ireland. Free movement of capital cannot be sustained as a point of principle when the economic costs are so devastating.

************************************************************

Some of the other articles in this issue are:

Two-speed EU back on the agenda!

Is there a trade war on the way?

Could the EU provide a solution to Ireland’s housing crisis?

EU banks have more than €1,000 billion in bad debt!

More euros to lend at low interest rates ?

Trade secrets

The security industry is shaping EU legislation: lobbyists in action!

More austerity for the Greeks

What to do in Europe? Proposals from the left

|

national |

housing |

press release

national |

housing |

press release

Monday February 27, 2017 22:18

Monday February 27, 2017 22:18 by 1 of Indyy

by 1 of Indyy

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter